vanguard tax exempt bond mutual fund

Indeed the performance of this Vanguard bond fund almost resembles the performance of most mutual funds. As of April 22 2022 the fund has assets totaling.

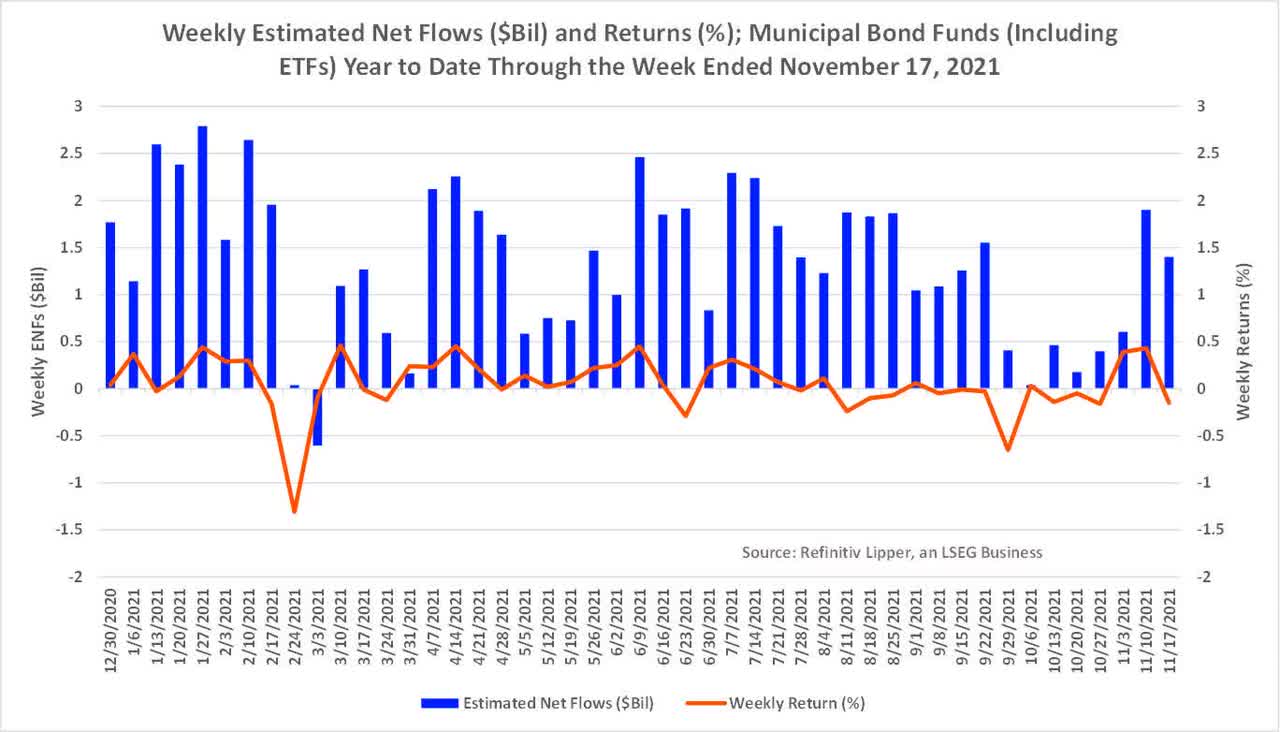

Municipal Bond Funds On Track For Record Inflows In 2021 Seeking Alpha

Choose a fund name to see standardized and after-tax returns.

. VTEB Vanguard Tax-Exempt Bond Index Fund. The fund has total assets over 20 billion making it a very large portfolio. The Vanguard Long-Term Tax-Exempt Fund is designed specifically for these high-income investors.

A 5-year return of 453 and a 10 year return of 484. At least 80 of its assets will be invested in securities whose income is exempt from federal and New Jersey state taxes. Find out if tax-exempt mutual funds are right for you.

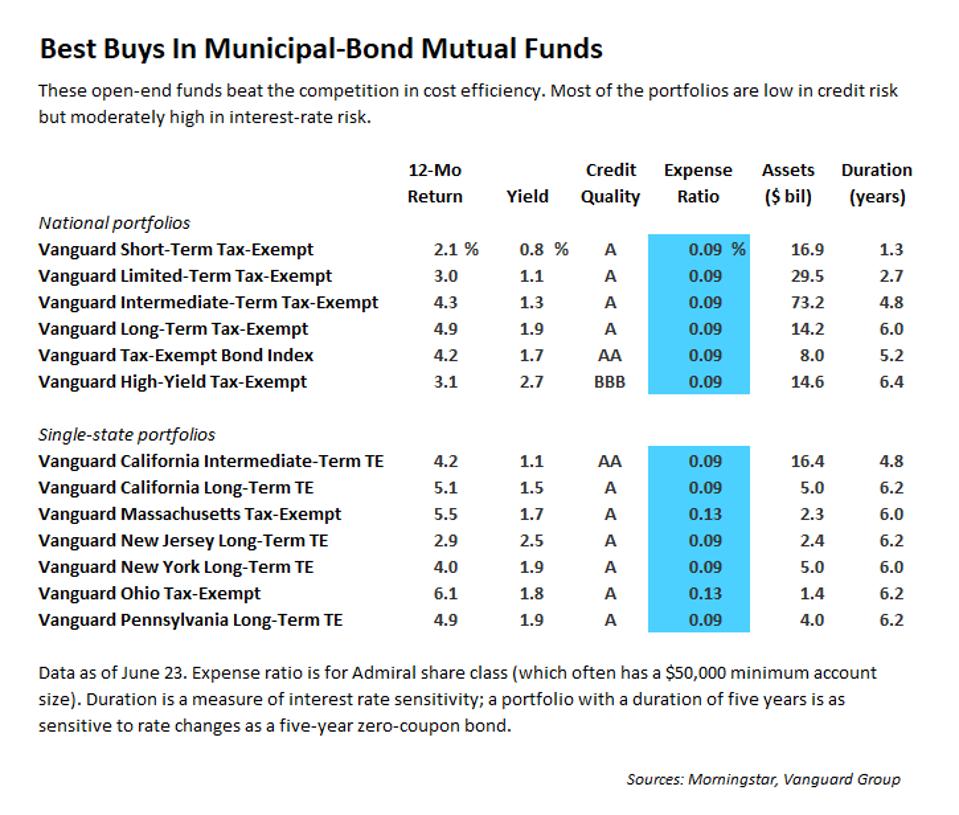

For mutual funds Indiana has provided informal guidance that the exemption applies to shares acquired before January 1 2012. Vanguard Tax-Exempt Bond Fund has an expense ratio of 009 percent. Cut your federal tax bill with a national tax-exempt fund.

Our goal is to help you get the most for your money by combining low costs diligent fund management and exceptional service. This index includes municipal bonds from issuers that are primarily state or local governments or agencies whose interest is exempt from US. If you own a bond mutual fund or ETF exchange-traded fund youll need to calculate the amount of income you earned from the funds government bond holdings if any in order to take advantage of this exemption when you file.

3 Interest earned from a direct obligation of another state or political subdivision acquired before January 1 2012 is exempt from Indiana income tax. Although tax-exempt mutual funds usually produce lower yields you generally dont have to pay federal taxes on earnings from tax-exempt money market and bond funds. Although the fund has no limitations on the maturities of individual securities its dollar-weighted average maturity is expected to be between 10 and 25 years.

Fees are Low compared to funds in the same category. To see the profile for a specific Vanguard mutual fund ETF or 529 portfolio browse a list of all. ERTS Wealth Advisors LLC.

Federal income taxes and the federal alternative minimum tax AMT. Latest News Macro Indicators ETF Database Mutual Fund Database Industry Explorer SEC Forms Finpedia Latest S1. 4 See state-specific insert for information regarding exemption.

The current yield on VWEHX is around 44 a very nice income stream. Vanguard Tax-Exempt Bond offers a broad portfolio of investment-grade tax-exempt municipal bonds at an attractive price earning a Morningstar Analyst Rating of Gold. VTEB Vanguard Tax-Exempt Bond Index Fund.

Vanguard NJ Long-Term Tax-Exempt Fund has an expense ratio of 017 percent. Latest News Macro Indicators ETF Database Mutual Fund Database Industry Explorer SEC Forms Finpedia Latest S1 IPO. Vanguard Tax-Exempt Bond ETF VTEB The fourth of the best Vanguard bond funds is the VTEB.

VTEB Vanguard Tax-Exempt Bond Index Fund. Income from bonds issued by the federal government and its agencies including Treasury securities is generally exempt from state and local taxes. Summit Wealth Retirement Planning Inc.

Strengthening Families Communities LLC. Open an account in 3 steps. If youre in one of the highest tax brackets and investing outside of your retirement account you may be able to reduce your tax exposure with a tax-exempt bond fund.

Latest News Macro Indicators ETF Database Mutual Fund Database Industry Explorer SEC Forms Finpedia Latest S1 IPO. VTEB Vanguard Tax-Exempt Bond Index Fund. Title for data aware layer.

Choose your mutual funds. According to Vanguard This low-cost municipal bond fund seeks to provide federally tax-exempt income and typically appeals to investors in higher tax brackets. The funds risk compared to other funds in its peer.

On top of the great yield the funds expense ratio is only 023. Fees are Low compared to funds in the same category. The funds expense ratio is 020 percent which is classified as low by Morningstar and is much lower than the average fund in its category.

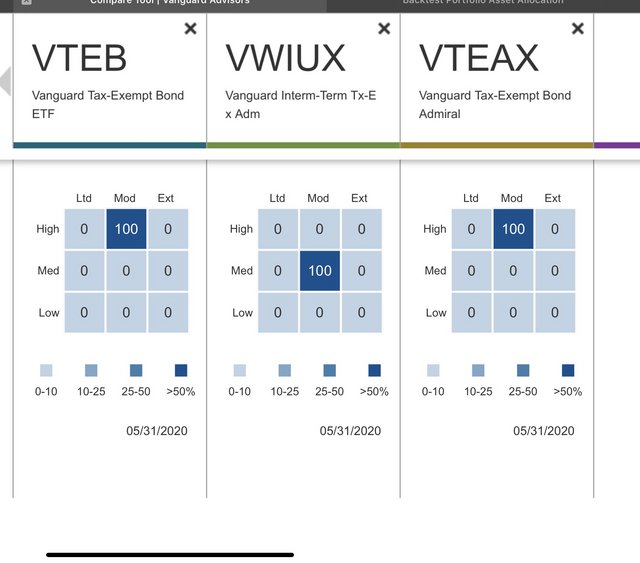

The fund tracks the. The data that can be found in each tab includes historical performance the different fees in each fund the initial investment required asset allocation manager information and much more. Decide which type of account.

Get added state-tax savings if you live in. Vanguard Municipal Bond To find out detailed information on Vanguard Municipal Bond in the US click the tabs in the table below. The fund is non-diversified.

This return is above average compared to most bond funds. Although the income from municipal bonds held by a fund is exempt from federal tax you may owe taxes on any capital gains realized through the funds trading or through your own redemption of shares. The fund invests in high-quality.

Latest News Macro Indicators ETF Database Mutual Fund Database Industry Explorer SEC Forms Finpedia Latest S1 IPO. All of the funds investments will be selected through the sampling process and at least 80 of the funds assets will be invested in securities held in the index. Vanguard mutual funds Vanguard ETFs Vanguard 529 portfolios.

The fund was established in 1978 and pays a monthly dividend. It has an outstanding 3 year return of 765. Compare up to 5 funds by choosing the checkboxes next to the funds and selecting the Compare button below the table.

Get the latest Vanguard Tax-Exempt Bond Index Fund Admiral Shares VTEAX real-time quote historical performance charts and other financial information to.

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Municipal Bond Funds And Etfs Attract Near Record Weekly Fund Flows Seeking Alpha

Portfolio Makeover 4 Moves To Consider In 2020 Capital Group Dow Jones Index Bond Funds Capital Market

The 7 Best Vanguard Index Funds For 2021 Kiplinger Mutuals Funds Bond Funds Stock Market Index

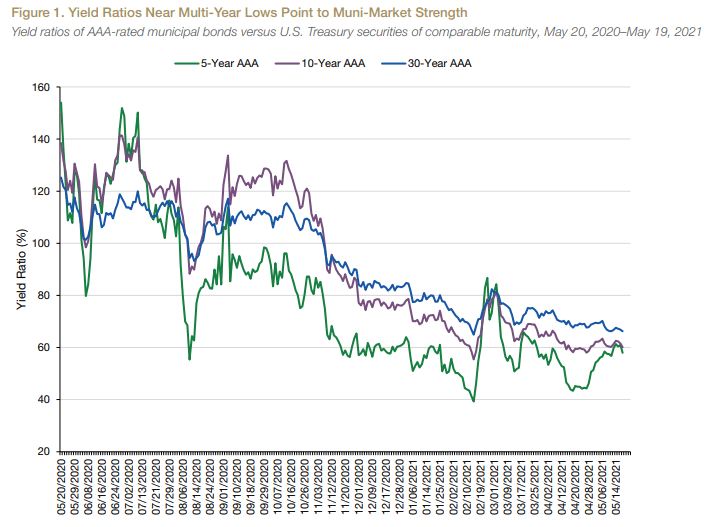

Our Approach To Tax Exempt Portfolio Allocation Seeking Alpha

Vanguard S New Venture Indexing Muni Bonds Morningstar

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Exchange Traded Fund Etf Explained In 2022 Investing Investment Portfolio Corporate Bonds

2 Questions About Vanguard S Tax Exempt Bond Index Bogleheads Org

Vanguard High Yield Tax Exempt Don T Call It Junk Kiplinger

How To Buy Municipal Bonds Ally

Best Municipal Bond Funds Best Mutual Funds Awards 2022 Investor S Business Daily

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

What Are Tax Exempt Funds Vanguard

Charts Municipal Bond To Us Treasury Yield Ratio My Money Blog

Municipal Bond Funds On Track For Record Inflows In 2021 Seeking Alpha